Estate Planning

Oct 27, 2025

Introducing Empathy to Estate Bureaucracy

ClearEstate’s origin story: how grief, inefficiency, and compassion inspired Alex to build a fintech that brings empathy and efficiency to estate planning and settlement

Learn how an alter ego trust can simplify estate planning for Canadian seniors. Avoid probate and secure your assets.

Article Contents

When searching for the perfect estate planning tool, it can be difficult to know which to choose. Many types of trusts exist to offer estate planning benefits: living trusts, family trusts, joint partner trusts, testamentary trusts, inter-vivos trusts, and the list goes on.

From joint partner trusts to testamentary trusts and everything in between, how do you know which to choose?

For seniors looking to secure their estates, alter ego trusts are a helpful but often overlooked tool in estate planning. Unique to Canada, this type of trust offers an alternative method of managing assets and a certain level of privacy that traditionally fashioned wills, as a public document once probated, may not.

An alter ego trust is a legal arrangement available to Canadian residents, which allows the transfer of assets to a designated trust, to which they are the sole beneficiary and retain control until their death. A legal relationship with beneficiaries may also be established, making it a compelling option.

When it comes to estate planning, these trusts can fulfill several purposes. They can help to avoid the lengthy probate process and streamline the transfer of assets, thus ensuring a quicker and more private transfer of assets to beneficiaries. They can also offer potential tax advantages, making them an attractive option for estate management.

Canadian law provides an alter ego trust as a means of greater flexibility and control in estate planning, especially for the aging population. Since being introduced in Section 104 of the Income Tax Act (ITA) in 2001, this kind of trust has helped many Canadians create efficient, tailored solutions for their asset distribution, allowing them to appreciate the full benefits the trust offers.

Alter ego trusts are tailored to meet specific needs within the Canadian legal system. The settlor may throughout their lifetime access funds as described in the terms of the trust, but upon death, the trust property will then be distributed to designated beneficiaries.

At its core, it’s a legal arrangement that allows someone 65 or older to transfer their assets into a trust, while still retaining the control and benefits, and ensuring the efficiency of the transer of assets upon the settlor’s death. This structure offers a blend of both control and benefits, with terms tailored to the needs of the individual.

Unlike a will, assets held in an alter ego trust are not required to undergo probate. This is particularly beneficial to settlors managing larger estates, or who want to minimize any public knowledge of their assets or beneficiaries.

An alter ego trust allows a Canadian resident aged 65 or older to transfer assets into a trust while maintaining full control as the trustee. Unlike traditional trusts, the settlor remains the only beneficiary during their lifetime, ensuring flexibility in managing assets while avoiding probate upon death.

The formation of an alter ego trust involves these few steps:

Remember that be able to create an alter ego trust, the individual must be at least 65 years old and both the settlor and the trust must be resident in Canada.

Key characteristics:

Alter ego trusts are specifically designed to cater to Canadian seniors, acknowledging the importance of asset management and control in the later stages of life. They offer the benefit of being treated separately for taxation purposes, offering solutions for tax planning opportunities. They also afford an extra layer of privacy for Canadians, where the public nature of probate and wills can be a concern for many.

Understanding these functions is useful for anyone looking to incorporate alter ego trusts as a valuable part of their estate management plans.

Choosing the right estate planning tool can be overwhelming, but understanding how each option—whether an alter ego trust, joint ownership, living trust, or will—aligns with your needs is crucial. Each legal and financial tool has its own set of advantages and limitations. Evaluating your estate goals and how these options can protect your assets will help you determine the most suitable solution.

A will is the most traditional form of estate planning tool. While a will outlines the desired asset distribution, it requires the public and often lengthy legal process known as probate.

In contrast, assets in an alter ego trust are able to bypass probate entirely, ensuring a quicker and more private transfer of assets, and thus avoiding probate taxes. Even more appealing is the fact that alter ego trusts offer a higher degree of protection, while wills can be challenged in court.

Joint ownership is often used for properties or bank accounts, allowing assets to be automatically passed to the surviving owner. This is another type of legal tool that avoids probate, but can create other challenges, such as lack of control over when and to whom the assets are distributed after a death.

Alter ego trusts allow increased and more detailed control in comparison, allowing the settlor to specify the terms of distribution and to protect against potential claims, both from creditors and marital disputes.

Alter ego trusts and living trusts both help with estate planning, but they serve different purposes. While living trusts can be used by anyone, alter ego trusts are specifically designed for Canadians aged 65 years old and more to offer probate-free wealth transfer, tax advantages, and greater control. Wondering which trust suits your needs? Contact our specialists for personalized guidance.

Alter ego trusts stand out in their ability to offer privacy, control, and tax advantages when navigating Canadian estate law. They’re particularly well suited for high-value estates or situations where assets are more complex, providing an efficient solution for managing and protecting assets during one’s lifetime, and offering a smooth transition after death.

Example 1: A high-net-worth individual

A senior with significant real estate holdings is an excellent example of someone who would benefit from using an alter ego trust in their estate plan. Using this legal tool, they can incorporate the properties into the trust, manage them during their lifetime, and specify the terms for their distribution after death. That the trust would avoid public disclosure and probate alike is another significant benefit for consideration.

Example 2: Complex family dynamics

In cases where family relationships are rockier or more complex, alter ego trusts can provide reassurance through clarity and control. For example, a settlor with children from more than one marriage can use the trust to outline how assets should be distributed among the children, minimizing disputes and ensuring fair inheritances.

For anyone trying to find the perfect planning tool for their particular estate, it’s helpful to explore the long term to see how alter ego trusts, like other estate planning tools, can offer unique benefits.

The initial setup of an alter ego trust includes legal and administrative fees. These starting costs can be higher when compared to drafting a will or setting up joint ownership, but the long-term savings can be substantial.

Alter ego trusts also avoid the legal costs and delays associated with probate, which can make a significant difference for larger estates. Bypassing probate allows alter ego trusts to provide considerable savings over time, and since these trusts offer better protection against legal challenges, they can further save on time and costs that might arise when choosing wills.

| Estate Planning Tool | Setup & Ongoing Costs | Probate & Legal Considerations | Tax & Protection Benefits |

|---|---|---|---|

| Alter Ego Trust | High initial setup; Moderate to High ongoing (trustee fees, tax filing) | No probate costs; High legal protection | Potential tax deferral/savings; Strong protection against challenges |

| Will | Moderate setup; Low ongoing until probate | Significant probate costs vary by province; Moderate legal protection | No tax benefits; Can be challenged in court |

| Joint Ownership | Low to Moderate setup (asset dependent); Low ongoing | No probate costs; Moderate legal protection | No tax benefits; Vulnerable to disputes |

| Living Trust | Moderate to High setup and ongoing costs | No probate costs; Moderate to High legal protection | Potential tax deferral/savings; Protection depends on structure |

Alter ego trusts provide significant tax advantages and probate savings, making them a powerful estate planning tool for high-value or complex estates. By deferring capital gains tax and bypassing probate fees, they help preserve wealth for beneficiaries while reducing administrative burdens.

When assets are transferred into an alter ego trust, they benefit from tax-deferred growth, meaning income is taxed at a lower rate depending on its type. Additionally, since these assets are not considered part of the estate at death, they avoid estate taxes and probate fees, resulting in significant long-term savings.

Certain estates benefit more from alter ego trusts due to their size, asset type, or complexity. Here are three key examples:

Estates with Appreciated Assets : Individuals holding stocks or other appreciating assets can transfer them into an alter ego trust to defer capital gains tax until death, maximizing tax efficiency.

Large Estates Avoiding Probate Fees : In provinces with high probate fees, estates worth millions can save tens of thousands of dollars by using an alter ego trust.

Estates with Complex Distribution Needs : When family dynamics are complicated, an alter ego trust provides clear, legally binding terms to minimize disputes and reduce legal costs.

Understanding the legal and financial complexities of alter ego trusts is crucial for maximizing their estate planning benefits. From tax implications to asset protection, knowing how these trusts work ensures better wealth management, probate avoidance, and long-term financial security.

Establishing an alter ego trust involves several steps and conditions, the first of which is the condition that the settlor is at least 65 years old and a Canadian citizen.

To create the trust, the legal process begins by drafting the trust deed, which outlines the terms of the trust, names beneficiaries, and outlines how the assets will be managed during life and distributed upon death. This trust document should be reviewed or written entirely by legal professionals to ensure that it reflects the settlor’s intentions and can support them in a legally-binding way.

Once the deed is prepared, assets are transferred into the trust. The transfers must be carefully managed to ensure that they align with the trust’s terms and with Canadian law alike.

On an ongoing basis, the trust must be managed in accordance with its terms, using attentive administration and often requiring legal or financial advice.

Despite the appealing tax benefits, alter ego trusts must still follow Canadian taxation and filing requirements. When assets are deposited into the trust, they’re considered a disposition at fair market value, which can trigger capital gains status.

The trust itself is taxed as a separate entity from the income or estate, and annual tax returns must be filed for it. Income earned within the trust is also subject to taxation at the trust level, unless it is distributed to beneficiaries, in which case it may still be taxed when received by them.

Trustees should always stay informed about their filing obligations, such as submitting the T3 Trust Income Tax and Information Return, and to ensure that all taxed are paid in a timely manner. Seeking assistance from a tax professional is recommended when navigating these complex processes.

Unexpected changed in tax legislation or trust law can affect how these trusts are administered and taxed. Because of this, it’s essential for individuals with an alter ego trust or considering getting one to stay informed about these changes.

For example, in 2016, the Canadian government introduced new rules on trust taxation, impacting how income generated within certain trusts is taxed. These changes led many trustees to adjust their estate planning strategies to minimize tax liabilities.

Regular consultations with legal and financial advisors is advisable to ensure ongoing compliance with any legal changes, and to take advantage of any new opportunities or adjustments.

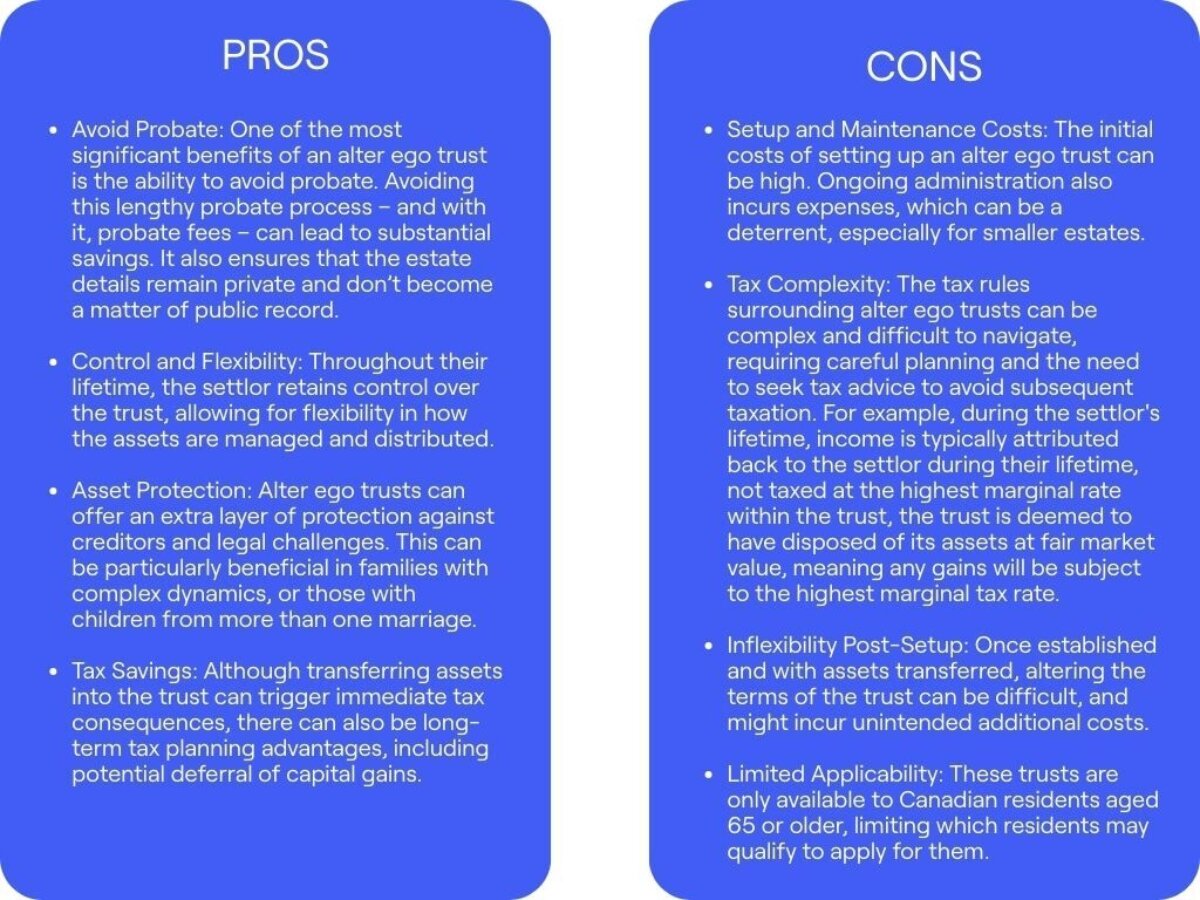

Alter ego trusts offer several advantages for estate planning, but they also present complexities that require careful consideration before committing to this kind of trust. Understanding the pros and cons and the financial implications for each, will help both trustees and beneficiaries decide whether this trust is the appropriate option. Legal advice from professional advisors is also invaluable in managing the risks and benefits associated with these trusts, as with any estate planning tool.

Inheriting from a trust comes with key financial implications—beneficiaries must understand how and when assets will be distributed, as well as potential tax considerations.

Trustees should also be informed of their tasks, as they have the responsibility of managing the trust in accordance with its terms. This requires a good understanding of the legal and tax obligations involved.

For Canadian couples seeking a seamless estate planning strategy, a joint partner trust offers the same benefits as an alter ego trust—but is specifically designed for two.This type of trust allows couples to pool their resources and make joint decisions about asset management, both during their lifetimes and after they're gone.

A joint partner trust is a specialized estate planning tool that allows Canadian couples to manage assets together while benefiting from probate avoidance and tax advantages.. It's designed with Canadian seniors in mind, requiring at least one partner to be 65 or older. The key difference is that joint partner trusts expand the circle of beneficiaries to include both partners in a marriage or common-law relationship.

With a joint partner trust, both spouses can benefit from shared income and asset control throughout their lives, ensuring financial security and continuity. This shared benefit continues until both partners have passed away. After that, the trust's assets are distributed according to the instructions laid out in the trust deed.

This structure offers a unique approach to estate planning for couples. It often aligns well with how many have handled their finances throughout their relationship, allowing for continued joint decision-making in their later years.

One of the most appealing aspects of joint partner trusts is their flexibility. The trust continues even after one partner passes away, allowing the surviving spouse to continue benefiting from the trust's income and capital. This can provide a sense of financial security and continuity during a difficult time.

Choosing between an alter ego trust and a joint partner trust depends on factors like financial goals, estate size, and desired level of control over assets. Some might prefer the shared approach of a joint partner trust, while others might opt for the individual control offered by separate alter ego trusts.

Both types of trusts offer similar advantages when it comes to probate avoidance and asset protection. They also share potential tax benefits, including the ability to transfer assets at cost basis. However, the strategies for maximizing these benefits might differ between the two trust types, given the involvement of two individuals in a joint partner trust.

While joint partner trusts can be an excellent tool for many couples, they're not without their complexities. The involvement of two individuals can sometimes lead to more intricate tax situations, especially if the partners have significantly different asset levels or estate planning goals.

As with any major financial decision, it's crucial to consult with legal and financial professionals when considering a joint partner trust. These experts can help navigate the nuances of trust law and ensure that the chosen structure aligns with both partners' wishes and long-term financial plans.

Thinking about setting up an alter ego trust? Consulting an estate planning specialist ensures you maximize tax benefits, protect assets, and avoid costly mistakes. We can provide needed professional advice on structuring the trust to meet specific needs, as well as how to manage it effectively to minimize risks. Regular legal reviews can keep the trust up to date both with current legal standards and personal circumstances, while giving settlors the chance to update it to incorporate any additional benefits.

Secure Your Legacy

Secure Your Legacy

Get your free 12-step Estate Planning checklist now. 89% of readers complete their estate plan within 3 months of using our guide.

Instantly Access Now