Estate Settlement

Dec 04, 2024

How Do Executors Mail Inheritance Checks?

Find out how inheritance checks are mailed, including security measures and what to do if there are delays in receiving them.

It isn't a mystery that settling an estate is expensive, we will be breaking down the costs associated with this emotional process

Regardless of whether you’ve found yourself shouldering the burden of settling one of your relatives’ estate with little forewarning, or have been mentally preparing yourself for your role as an executor for months or even years, the truth is that settling your loved one’s estate is rarely cheap.

Sure, simple and straightforward estates with little assets, a will, no debt, and cooperative beneficiaries can be settled quite easily and without incurring a lot of costs. But the reality is that the costs of settling an estate can balloon way beyond your estimates.

Here are some costs you need to be aware of when taking on the responsibility of settling your loved one’s estate:

We regularly share relevant information about wills and estates.

The process of validating the deceased’s will through a courthouse and creating an estate settlement plan if there isn’t a will is known as the probate process. The executor of the estate is in charge of carrying out the wishes outlined in the will and overseeing the process of passing the assets of a deceased person onto living beneficiaries. The probate process includes submitting the will to probate court for inspection to ensure that it’s valid, as well as officially granting an executor power to manage the estate settlement.

Probate is not free: You’ll have to pay probate fees or estate administration tax to the provincial or territorial government.

Probate fees are dependent on the size of the estate and on the province or territory where the probate process is being conducted. Some provinces, like Alberta, charge as little as $35 for estates under $10,000, while some charge significantly higher. In Ontario, for instance, an estate worth $250,000 might rack up fees well over $3,000.

There’s a reason why people try to avoid getting lawyers and accountants involved when settling an estate: It becomes very expensive, very fast. The average estate lawyer in Canada with less than one year of experience charges $213 per hour. Lawyers with more than 20 years of experience charge $437 on average.

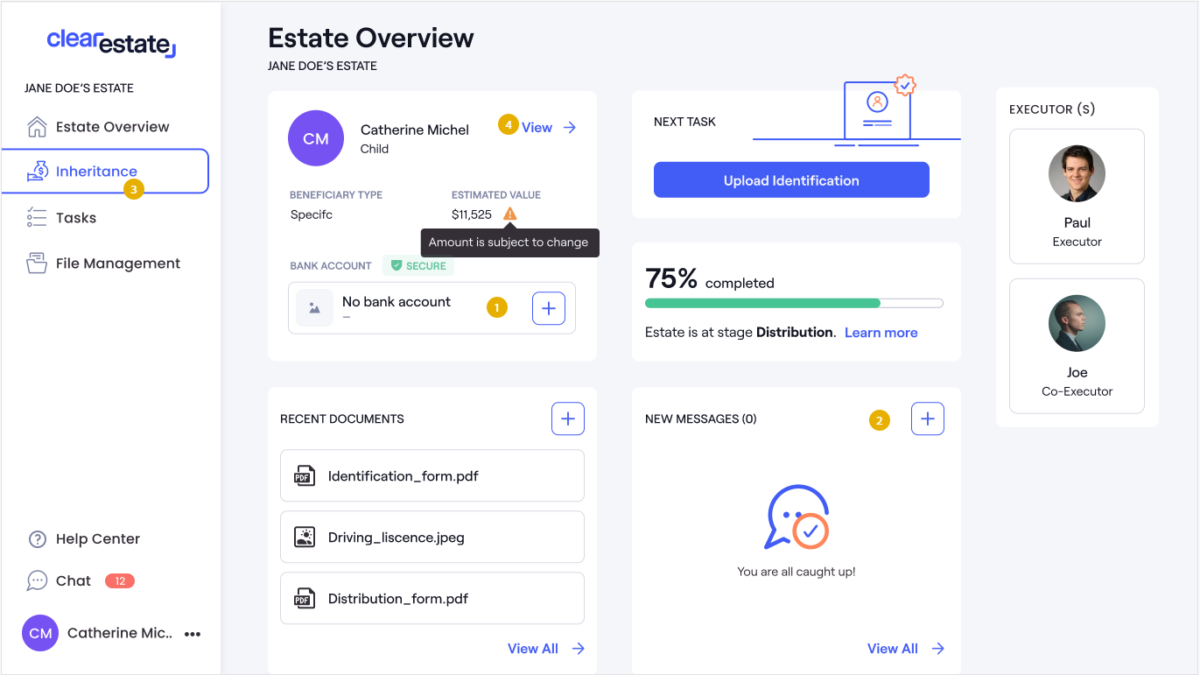

If a beneficiary or an outside party contests the will, then legal costs can skyrocket and the settlement process can drag on for years, so avoid any bad blood right from the start by creating transparency around the whole process. With the help of ClearEstate’s beneficiary portal, for example, you can ensure that all beneficiaries are able to view the progress of the settlement, receive a summary of what assets they’re entitled to, and keep detailed records of all communications. Building trust and maintaining transparency is key for a smooth process.

Then there’s the old adage that death and taxes are the only sure things in life, and it certainly holds true in the estate settlement process. The executor will have to file a number of returns, including any outstanding tax returns the deceased may have had (including a terminal return). They’ll also have to submit an estate income tax return if any assets—such as investments—earn income during the probate period. The more complex the estate, the more convoluted it can get for an executor—which is when they call in an accountant, understandably so. Just keep their fee in mind when trying to estimate what this process can cost.

Part of an estate executor’s job is to also make funeral arrangements. The cost of the service is going to depend on the wishes of the deceased—did they want to be cremated, or buried? Did they specify a location? How did they envision the ceremony? All of these factors will determine how much the funeral is going to cost.

On average, a burial costs between $5,000 and $10,000 in Canada. Cremations can cost between $2,000 and $5,000.

A crucial part of settling an estate consists of appraising all of the estate’s assets, creating a thorough inventory of everything, and ensuring all of the estate's beneficiaries receive their designated share. While this sounds (sort of) simple, in theory, the truth is that actually allocating and distributing those assets can incur several additional costs you may not have thought of.

For example, if someone passed away and left their house behind with the instruction to sell it—or the executor needs to sell it in order to pay the estate’s debt—then that house needs to be cleaned, probably with the help of a professional cleaning company. The same goes for any real estate that forms part of the estate and is marked for sale.

You may also need to ship assets, such as personal items like paintings, jewelry, or furniture, to beneficiaries who live further away. Depending on the size, value, and weight of those assets, those shipping costs can add up fast.

These are some of the key costs that can sneak up on estate executors if they’re not prepared. One of the surest ways to avoid unnecessary costs and surprises is to prepare as much as you can before your loved one passes away, including ensuring the will is up to date and accessible and that a list of all financial accounts, important documents, and insurance policies are prepared and ready.

Simplify Probate Today

Simplify Probate Today

Get expert guidance from our probate specialists who've helped 10,000+ families.

Book a free consultation today