Estate Settlement

Dec 04, 2024

How Do Executors Mail Inheritance Checks?

Find out how inheritance checks are mailed, including security measures and what to do if there are delays in receiving them.

Dying without a will in Ontario presents challenges. Discover the laws of intestate succession and settling an intestate estate.

We don’t know if you’ve heard, but having a will is pretty important. It sets the foundation for a smooth and seamless transfer of assets from the estate of the deceased to the beneficiaries. However, a study from 2018 determined that over 51% of Canadians don’t have a will, which means that it’s probably not uncommon for people to pass away without leaving a will. What happens then?

Dying without a will in Ontario means you’re considered to have died “intestate.” This situation takes the decision-making power away from you and your loved ones and into the hands of the state. In the case of an intestate death, Ontario's Succession Law Reform Act steps in and dictates how the estate is distributed.

Intestate succession in Ontario involves a structured and complex process defined by the Succession Law Reform Act, which dictates the distribution of a person's estate if they die without a will. The implications of not having a will can be profound, especially considering that common-law spouses are excluded from inheriting under intestate succession rules. Therefore, having a will is paramount for common-law couples.

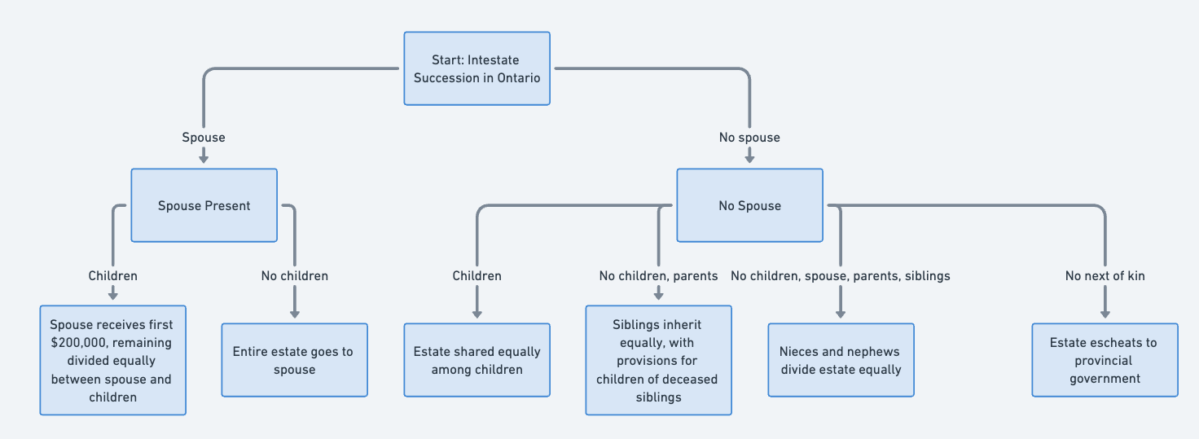

The legal framework in Ontario for intestate succession seeks to provide an equitable distribution of assets among the closest relatives of the deceased. Here's a summary of the rules:

In Ontario, the preferential share allotted to a surviving spouse in the event of intestacy has seen an increase, moving from $200,000 to $350,000.

This adjustment is applicable to the estates of individuals who have passed away on or after March 1, 2021. For estates of persons who died before this date, the preferential share remains at $200,000, as set out by the recent updates in the guidelines under the Succession Law Reform Act.

Consequently, understanding intestate succession is essential for everyone, not only those with substantial assets, to avoid unintended consequences and to uphold the principles of fair and just distribution of property.

In Ontario, common-law partners face unique challenges under the Succession Law Reform Act (SLRA). Unlike married couples, common-law partners are not recognized as a "spouse" for intestate succession, leaving them potentially without a claim to their partner's estate if no will is in place.

Joint bank accounts add further complexity, as the surviving partner is presumed to hold the funds in trust for the deceased's estate. Proving the intent behind these funds may require legal action.

Despite these challenges, the SLRA does allow for a Dependent's Claim by a common-law partner. To qualify, specific criteria must be met, such as living together for no less than three years or having children in a permanent relationship. These claims can provide support but are evaluated on various factors, making them neither simple nor guaranteed.

Administering an estate without a will, is a complex process requiring a meticulous approach and adherence to specific legal requirements.

The responsibility of managing the estate falls to an appointed estate trustee, whose duties and challenges are highlighted below.

The estate trustee, appointed by the courts in Ontario, carries significant responsibilities. While anyone resident in Ontario may be appointed, there's a presumption of entitlement favoring 'spouse, then next of kin,' even if common law spouses have no right to inherit from an intestate estate.

Applications can be approved 'over the counter' if the person highest in the order of entitlement applies or provides renunciations from everyone above them. In cases of conflict or if the applicant is not on this list, a formal application to a judge is required. If two people of equal claim want to be appointed, the court must decide, often leading to the appointment of an independent third party, like a trust company.

The estate trustee's responsibilities include:

Being appointed as the estate trustee of an intestate estate in Ontario is a substantial responsibility and requires satisfying specific criteria and completing several legal steps. Here's an overview:

Eligibility: Though anyone resident in Ontario can theoretically be appointed, the court tends to favor 'spouse, then next of kin'. However, appointment of someone living outside Ontario might be conceivable in rare cases if the estate is simple and debt-free.

Application for Probate, No Will: The applicant who will be applying for a certificate of appointment of estate trustee without a will - needs to fill out (Form 74.14). This is the actual application for the certificate of appointment.

Notice Requirement: The applicant must notify all beneficiaries (Form 74.17). This notice must be sent to all beneficiaries who have a claim to the estate, so that they know someone is applying to probate the estate.

Consent Requirement: The applicant needs to secure original signed consents from beneficiaries with a majority interest in the estate's value.

Special Considerations for Minors and Mentally Incompetent Beneficiaries: If beneficiaries include minors or mentally incompetent individuals, notice must be served to the appropriate parties.

Bonds: The general rule is that the proposed estate trustee must post a bond equal to double the estate's value. The court may waive this requirement at its discretion. (The bond serves as a financial guarantee to ensure that the estate trustee will carry out their duties responsibly. However, the court may waive this requirement if, for example, all the beneficiaries are adults and they all consent to the waiver.)

The Application: The applicant must complete, file, and properly execute the application with the appropriate Court registry, including all required evidence, affidavits, bonds, and payment of the Estate Administration Tax.

Conflict Resolution: In case of conflict or equal claim, the court must decide who will be appointed, possibly leading to the selection of an independent third party.

Have you been entrusted with the responsibility of an estate but reside outside of Ontario?

With hundreds of probate filings we manage every quarter in Ontario, we've witnessed non-residents grappling with the challenges of obtaining a certificate of appointment.

But don't worry, we're here to simplify the process for you.

Book a free consultation today and let us help you navigate this crucial responsibility with ease.

Being appointed as the estate trustee is a meticulous process that underscores the significance of professional legal guidance.

By understanding and meeting these criteria, the appointed estate trustee can embark on the crucial role of managing and distributing the deceased's assets according to the intestacy rules of Ontario.

Probate without a will is more complex and time-consuming, with additional notice and consent requirements. Minor children and mentally incompetent beneficiaries add layers of complexity, with required notices to guardians, attorneys, The Children’s Lawyer, or The Public Guardian and Trustee.

The estate trustee without a will must post a bond equal to double the value of the estate, though the court may waive this requirement. Preparing the application for appointment, gathering consents, notifying beneficiaries, and managing various legal documents and fees make the process even more arduous.

Administering an intestate estate in Ontario is a complex and often overwhelming responsibility. From understanding the Succession Law Reform Act to fulfilling your duties as an estate trustee, each step is fraught with legal intricacies that require meticulous attention to detail.

Don't navigate this complicated process alone. Professional legal guidance can help you ensure that you're fulfilling your responsibilities accurately and efficiently, minimizing the risk of legal complications down the line.

👉 Reach Out for Expert Assistance

Take the guesswork out of estate administration. Click below to schedule a consultation with our experienced estate law professionals who can guide you through each step of the process.

A: In the unfortunate event in which the deceased passed away without leaving a will, the spouses share of inheritance largely depends on if the deceased left behind children or not.

If there are no children: The spouse is set to receive the entire estate

If there are children: The spouse may be entitled to the estate value of up to $350,000 and the remainder will be split between the children.

If there is no executor (estate trustee), Ontario's laws dictates that the next of kin and spouse will be next in line to apply to be a trustee in Ontario.

But if no one wants to take on the role to be an executor, the Ontario courts will appoint a public trustee.

Simplify Probate Today

Simplify Probate Today

Get expert guidance from our probate specialists who've helped 10,000+ families.

Book a free consultation today