Estate Planning

Nov 29, 2024

7 Critical Trust Fund Mistakes Parents Must Avoid in 2025

Setting up a trust fund? Learn the biggest mistake parents make and ensure your child's financial security with expert guidance.

Explore the key aspects of Powers of Attorney in BC, covering types, creation, and selection of attorneys for secure future planning and peace of mind.

A Power of Attorney (POA) is a legal document that allows you to appoint someone you trust, known as an "attorney," to manage your financial or legal affairs on your behalf.

In British Columbia, this can include tasks like paying bills, managing investments, or buying and selling property. The person granting the power is called the "donor."

There are different types of POAs in British Columbia:

1. General Power of Attorney : This gives the attorney broad powers to handle all of the donor's financial and legal matters, but it becomes invalid if the donor doesn't have his mental capacity anymore.

2. Enduring Power of Attorney : This continues to be valid even if the donor becomes mentally incapacitated, making it a crucial tool for planning for future incapacity.

3. Limited Power of Attorney : This grants the attorney the power to act on the donor's behalf for specific tasks or for a limited time period.

Creating a Power of Attorney (POA) can be important for several reasons :

Planning for Incapacity: A POA allows you to designate someone you trust to manage your affairs (eg; financial affairs) if you become incapacitated due to illness or injury. This ensures that your financial and legal matters are handled according to your wishes even if you're unable to make decisions yourself.

Convenience: If you're traveling, living abroad, or otherwise unavailable, a POA can empower someone to handle your financial transactions, such as paying bills, managing investments, or buying and selling property on your behalf.

Health Care Decisions: A specific type of power of attorney document, known as a Healthcare Power of Attorney or Medical Power of Attorney, allows you to appoint someone to make medical decisions for you if you're unable to communicate your wishes.

Business Continuity: If you own a business, a POA can ensure that operations continue smoothly in your absence by granting a trusted individual the authority to make business decisions.

Creating an Estate Plan: A POA is a crucial component of a comprehensive estate plan. It helps ensure that your financial and legal matters are managed according to your wishes, complementing other estate planning tools like wills and trusts.

Legal Protection: Having a POA in place can provide legal protection for both you and your designated agent, as it clearly outlines the scope of authority and responsibilities.

In order to create a valid POA in British Columbia, understanding the legal framework and following specific requirements is required.

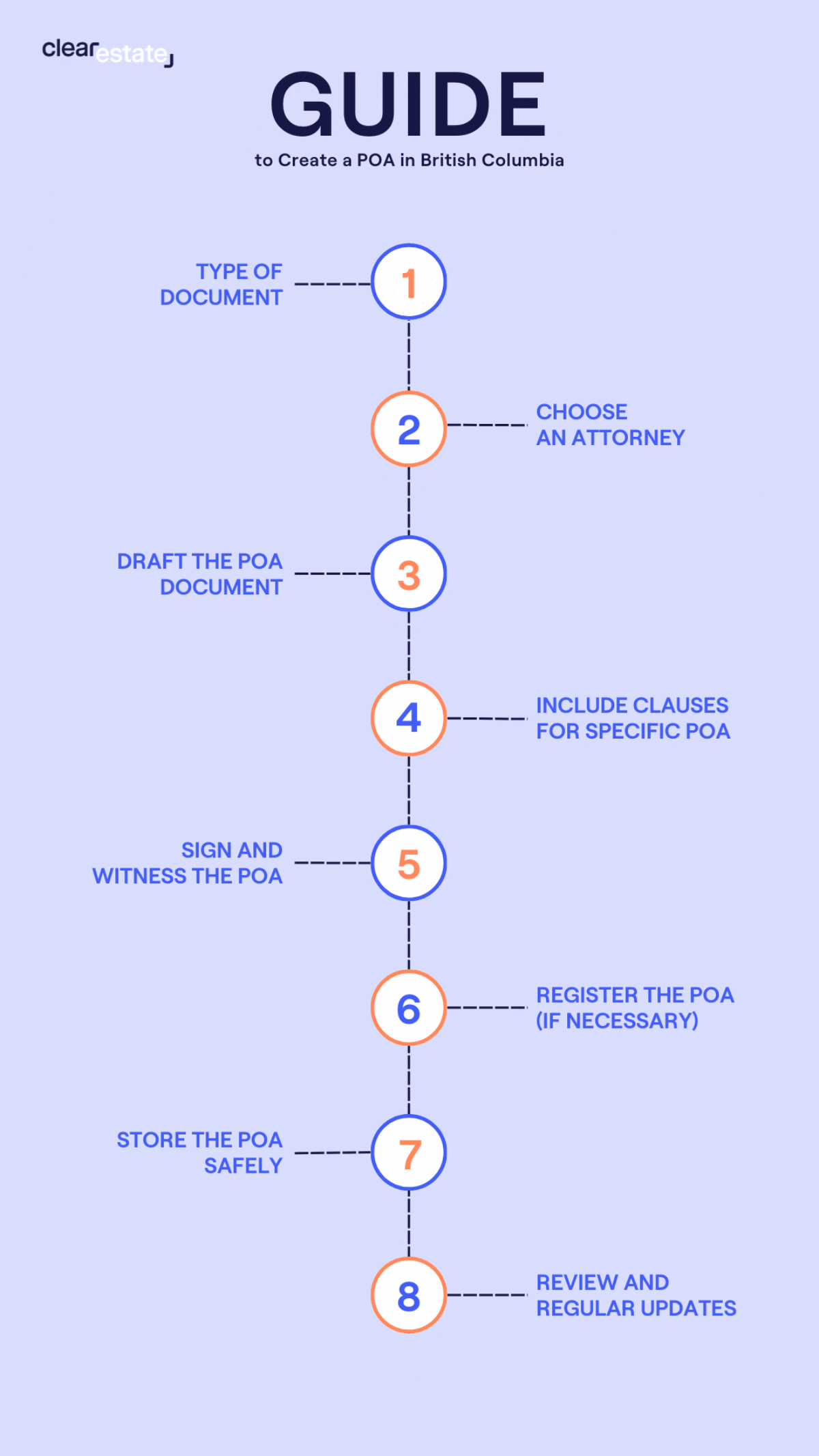

Here's an outline of the legal framework and a step-by-step guide for creating a POA in BC:

- Legislation : The main legislation governing POAs in British Columbia is the Power of Attorney Act and the Adult Guardianship Act.

- Types of POAs : BC recognizes different types of POAs, including General Power of Attorney, Enduring Power of Attorney, and Limited Power of Attorney.

- Capacity : The donor must have the mental capacity to understand the nature and consequences of creating a POA.

- Witnessing : The signing of the POA must be witnessed according to the requirements set out in the Power of Attorney Act.

1. Type of Document :

Decide whether you need a General, Enduring, or Limited Power of Attorney based on your specific needs.

2. Choose an Attorney:

Select a trustworthy person (or persons) to act as your attorney. Consider their ability to manage financial affairs and their willingness to take on the duties of attorney.

3. Draft the Power of Attorney Document:

Prepare the Power of Attorney document, clearly outlining the powers of attorney you are granting. You can use a legal template or seek assistance from a lawyer to ensure that the document meets legal requirements.

4. Include Clauses for Specific Powers of Attorney:

If you wish to grant specific powers or impose restrictions, clearly detail these in the power of attorney document.

5. Sign and Witness the POA:

The POA must be signed in the presence of two adult witnesses, neither of whom can be the attorney or the attorney's spouse. Alternatively, a British Columbia lawyer or notary public can witness the signing.

6. Register the POA : (if necessary)

While registration is not mandatory, an Enduring Power of Attorney should be registered with the Land Title Office if it will be used for real estate transactions.

7. Store the POA Safely:

Keep the original POA document in a secure location and provide copies to your attorney and other relevant parties.

In British Columbia, the choice of who to appoint as your POA is an important decision, as the power of attorney can have significant control over your financial and legal affairs.

Here are the eligibility criteria and considerations for choosing a POA:

- Legal Age: The person appointed as Power of attorney must be an adult, which means they must be at least 19 years old (age of majority) in BC.

- Mental Competency: The appointee must have the mental capacity to understand the responsibilities and duties of acting as a POA.

- No Disqualifications: Certain individuals, such as undischarged bankrupts, may be disqualified from acting as a POA depending on the circumstances and the nature of the powers being granted.

Is he/she trustworthy ?

The most important consideration is trust. Choose someone who you trust implicitly to manage your affairs (eg; financial matters) and make decisions in your best interest.

Does he/she understands the duties ?

Ensure that the person you appoint understands the responsibilities involved in being a POA, including the need to act honestly, in good faith, and within the scope of the powers granted.

His/her Financial Acumen ?

Consider the person's ability to manage financial matters, as your power of attorney must handle your assets and financial transactions.

Is he/she available ?

Choose someone who is likely to be available and willing to act as your POA for the foreseeable future. Consider their health, location, and other commitments.

Is he/she willing to do it ?

Discuss the role with the potential appointee before making a decision to ensure they are willing and able to take on the responsibility.

Can I have more than 1 POA ?

You may choose to appoint more than one person as your POA, either to act jointly (all power of attorney must make decisions together) or jointly and severally (can act independently).

This can provide a system of checks and balances but may also lead to complications since the powers of attorney may disagree.

After selecting your POA, it is advisable to have an open and detailed discussion with them about your expectations, the scope of their powers, and any specific wishes or instructions you have. This ensures that they are fully aware of their duties and are prepared to act in your best interests.

In order to revoke a POA in British Columbia, you need to follow certain steps to ensure that the revocation is legally valid and effectively communicated to all relevant parties.

Here's how you can do it:

1. Put It in Writing: State on a written document your intention to revoke the POA. This document is often called a "Revocation of Power of Attorney." It should include your name, the date, a clear statement that you are revoking the POA, and the date of the original POA document.

2. Sign and Date the Revocation: Sign and date the revocation document in the presence of a witness, who should also sign it. The witness should be an adult who is not the attorney you are revoking the power from.

3. Notify the Attorney: Provide the attorney with a copy of the revocation document, informing them that they no longer have the authority to act on your behalf.

4. Notify Third Parties: Inform any banks, financial institutions, or other third parties who may have been dealing with the attorney under the POA that he has been revoked. Provide them with a copy of the revocation document.

5. Destroy Original POA Documents: To prevent any confusion or misuse, destroy all original copies of the POA document, or mark them as "revoked."

6. Keep Records: Retain a copy of the revocation document for your records.

It's important that if you have registered the POA with the Land Title Office (for example, for real estate transactions), you should also file the revocation document with the Land Title Office to officially record the revocation.

Understanding Power of Attorney (PoA) in British Columbia is a vital step for anyone considering how best to manage their affairs in the event the are unable, unwilling, or unavailable.

At ClearEstate, our focus on estate planning ensures that your PoA arrangements are thoughtfully aligned with your personal goals and needs. Remember, a PoA is more than a document—it's a key part of your planning toolkit for ensuring your affairs are handled according to your wishes, especially when you might not be able to oversee them yourself.

Discover how we can personalize your estate planning for your peace of mind. Book a free consultation with our experienced team today and take the first step towards secure and effective management of your affairs.

Q : "When does a POA end?"

A : A POA can end under various circumstances, depending on the type of POA and the specific provisions outlined in the document. The circumstances can go from revocation, expiration date of the POA, death of the donor or the attorney.

Q : "Is a POA entitled to compensation in BC ?"

A : In British Columbia, whether a Power of Attorney is entitled to compensation depends on the terms of the POA document and the nature of the tasks performed.

Q : "Does an enduring power of attorney have to be notarized in BC?"

A : In British Columbia, an enduring power of attorney (EPOA) does not have to be notarized, but it does need to be signed in the presence of specific witnesses to be legally valid.

Although notarization is not a legal requirement, having an EPOA notarized can provide an additional level of assurance regarding the authenticity of the document and can be helpful if the document is going to be used in another jurisdiction or if there is a concern about potential challenges to its validity.

Secure Your Legacy

Secure Your Legacy

Get your free 12-step Estate Planning checklist now. 89% of readers complete their estate plan within 3 months of using our guide.

Instantly Access Now