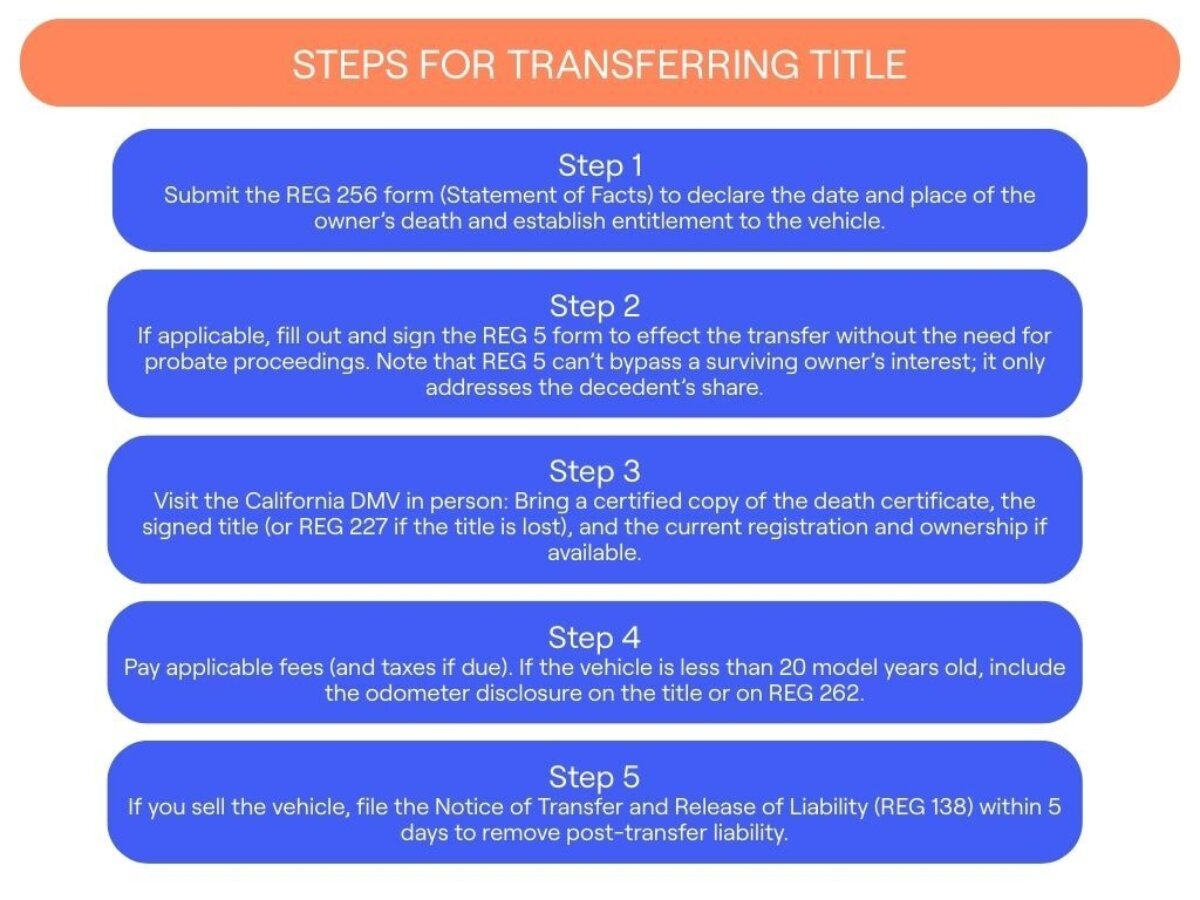

As the transfer of a personal vehicle after death of the owner being most common without probate in the State of California, the DMV provides a simple process for executors. Below are general steps you can follow.

1. Wait the prescribed period and gather documentation

Forty days must have passed since the vehicle owner’s passing.

During this time gather the required documents, which include an original death certified (or certified copy), the California Certificate of Title and a copy of the will of the decedent.

If the vehicle was owned by two or more decedents (i.e. husband and wife who have both died) original or certified copies of both death certificates, and a completed REG 5 form for the most recent decedent, must be submitted.

2. Complete the REG 5 form

The uncomplicated REG 5 form (Affidavit for Transfer Without Probate) will transfer the vehicle in question from the estate of the deceased to a relative, or specified beneficiary in the Will. The new owner can then decide whether to keep the vehicle, sell it, or perhaps trade it for something different.

The REG 5 must be completed by one of the following:

The person or persons specifically designated in the decedent’s will to take ownership of the property upon death.

The guardian or conservator who succeeded to take control of the decedent’s property under death.

A beneficiary specified in the decedent’s will to take possession of the vehicle after his/her passing.

A designated Trustee appointed by the decedent prior to death.

In order for a vehicle to be transferred to a new owner without probate, the vehicle must be titled in California. If it’s titled in another state, handle the transfer under that state’s rules before bringing it into California. It’s important to note that states may not have the same vehicle transfer requirements as in the decedent’s home state.

Note that if the vehicle was owned by two or more persons, but only one of the two is deceased, the REG 5 form cannot bypass a surviving owner’s interest. If one owner survives, that person signs the title as the owner. If the survivor also wishes to release the decedent’s interest, submit REG 5 for the decedent’s share.

Important: The REG 5 form cannot be used if the value of the estate exceeds certain limits. If the owner(s) passed away prior to March 31, 2025, the value of their estate must be less than $184,500. If the owner(s) passed after April 1, 2025, the value of their estate must not exceed $208,850 to be eligible for a transfer using REG 5. However, the value of the vehicle to be transferred is not included in this threshold calculation. Additionally, California law allows the transfer of a vehicle “irrespective” of its value, so long as there is no other property that necessitates probate*.