Getting Consents and Signatures:

No petition moves forward without the green light from a few key entities.

Registrar's Approval: The registrar, a critical figure in property title transfers, must provide consent. Upon obtaining a properly filled-out petition, the registrar will play an instrumental role, including memorializing the petition and eventually issuing the new certificate of title.

State Attorney General's Consent: In New York, the consent of the state attorney general is indispensable. This ensures an additional layer of verification, aligning the transfer with state interests and regulations.

Signature from a Justice of the Supreme Court: Last, but certainly not least, is the approval from the judiciary. A justice of the supreme court must sign the verified petition and order. This judicial endorsement ensures that the transfer is in accordance with the state's legal standards.

Providing Sufficient Evidence:

It's not just about filing papers. It's about proving the legitimacy of the claims within them.

'Sufficient and Conclusive' Evidence: The law doesn't merely require evidence; it demands evidence that is both ample and definitive. This means the proof provided must be robust, leaving no room for doubt regarding the heirs-at-law and their rightful claim to the property.

Identifying All Heirs-at-law: To ensure a smooth process, it's pivotal to clearly identify all legitimate heirs. This step safeguards against future disputes and ensures all parties with a rightful claim are accounted for.

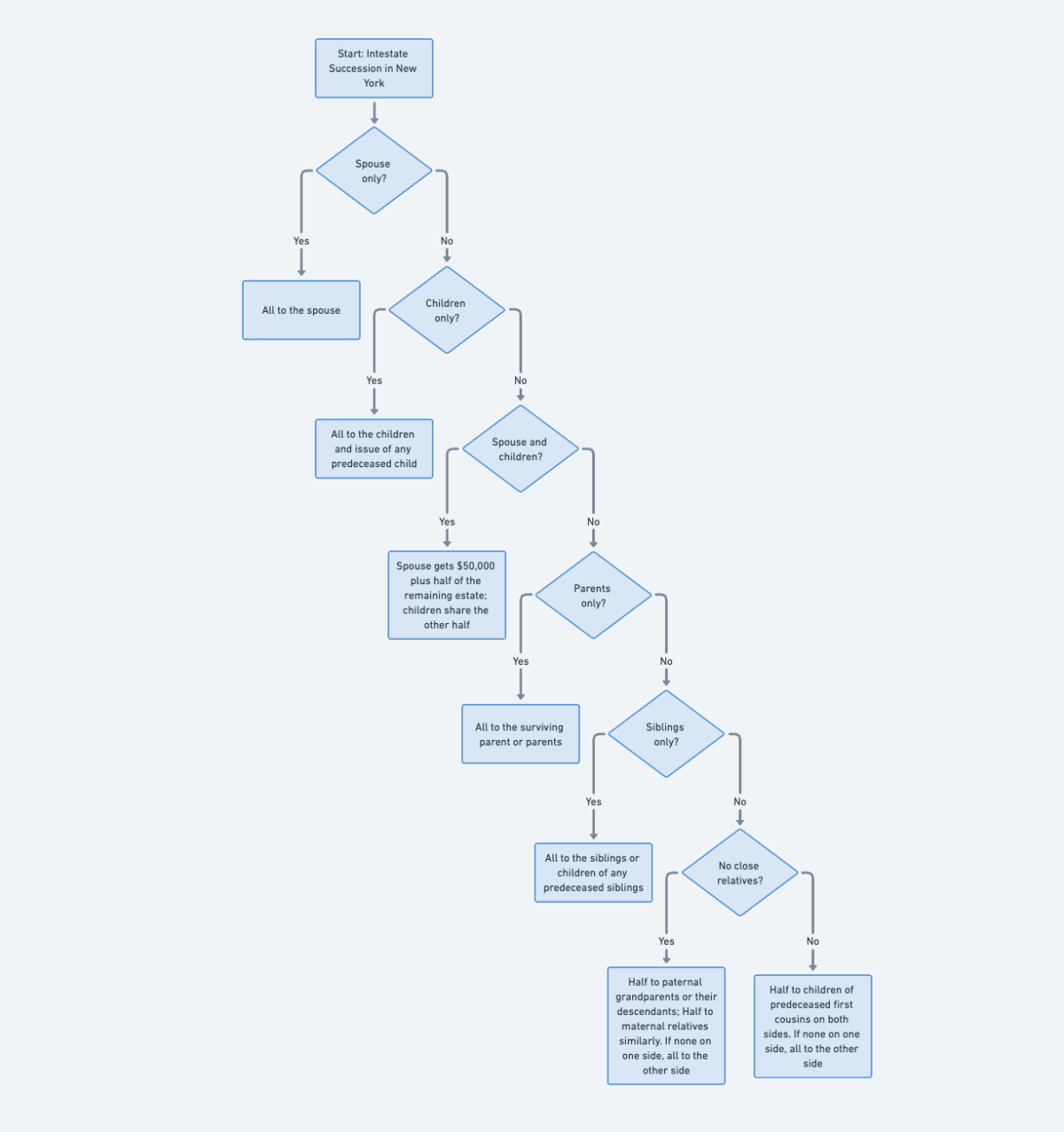

Property Distribution in New York According to The Laws of Intestacy:

Intestacy might sound like a complicated term, but its essence is quite straightforward.

Definition of Intestate: When someone dies 'intestate', they have passed away without leaving a valid will. In such scenarios, the state's intestacy laws take precedence in determining property distribution.

New York's Intestacy Laws: In the absence of a will, New York's laws lay out a clear hierarchy of successors.

This sequence starts with the spouse and descendants and then moves to other relatives if the former are nonexistent. The state ensures that property gets distributed in a manner that reflects potential wishes of the deceased, as deduced from familial ties.

For illustration, we've created a flow chart to help you gain a visual understanding of how assets, pass along according to the intestate succession laws in New York: