Estate Settlement

May 01, 2025

What to Do When Someone Dies in California

Follow this step-by-step guide to navigate legal duties, probate, and estate tasks with clarity and confidence.

Get clarity on Nevada probate laws with no will. Our guide explains intestate succession and asset distribution for bereaved families.

When a loved one passes away without leaving a will, it often leaves us wondering what happens to their belongings. In legal terms, dying without a will is called passing "intestate" - and that's where Nevada's intestate succession laws step in to guide the process.

Our article dives into the key aspects of Nevada probate laws for estates without a will. We'll walk you through how intestate succession works, whether the deceased was married or single. You'll learn which assets fall under these laws and how Nevada handles unique family situations.

By the end, you'll have a clearer picture of what happens when someone dies without a will in Nevada, helping you navigate this complex situation with more clarity.

Intestate succession refers to the laws that determine how assets are distributed when someone dies without a valid will.

In Nevada, these laws are designed to pass assets to the deceased person's closest living relatives according to a specific hierarchy. While this may not always match the deceased's actual wishes, it provides a standardized approach for handling estates without wills.

The specific laws that outline Nevada's intestate succession distribution can be found in Nevada Revised Statutes (NRS) Chapter 134. These statutes provide detailed guidance on how assets should be allocated based on the deceased's family structure.

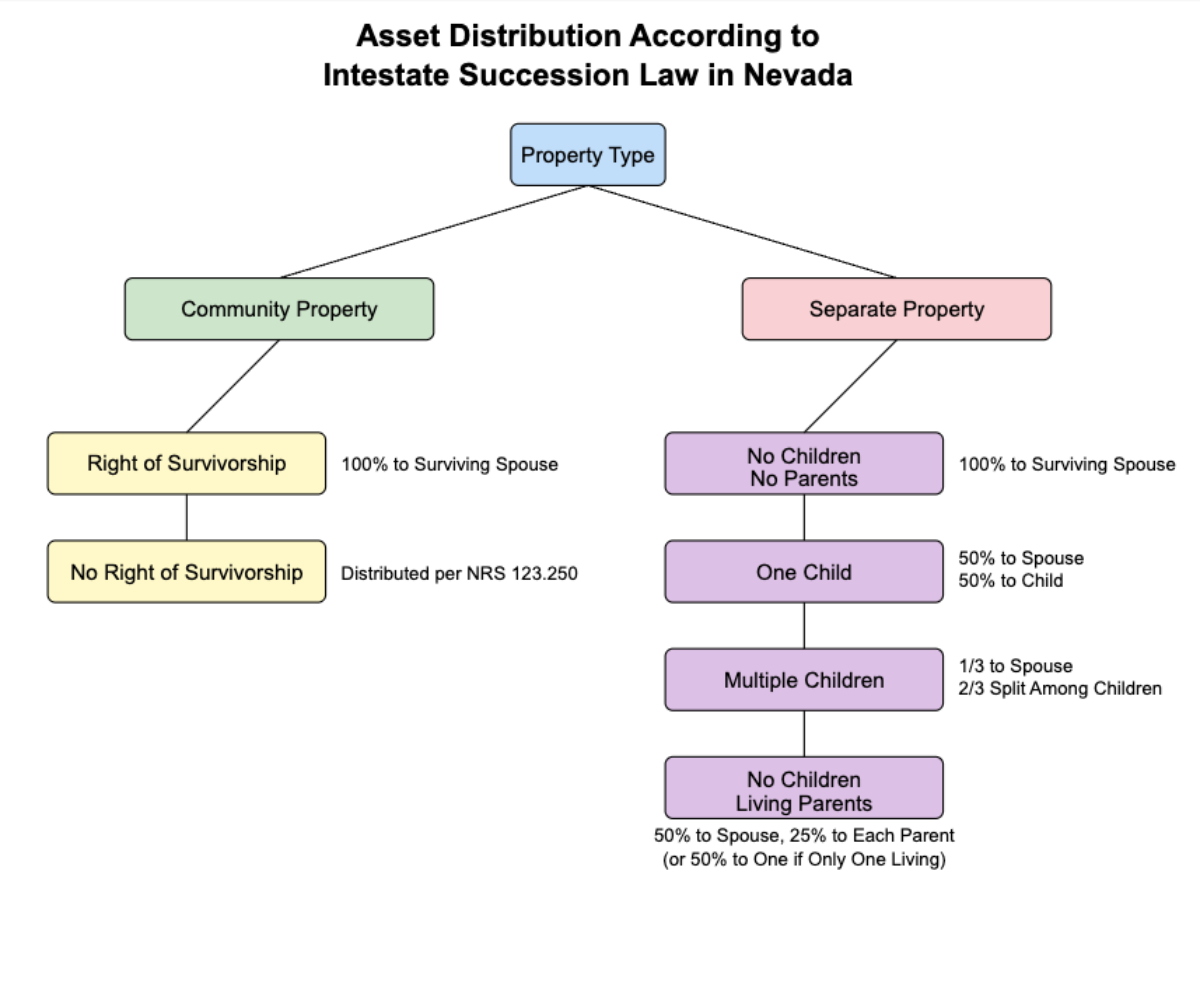

Nevada is a community property state, which plays a significant role in asset distribution for married individuals who die without a will.

According to Nevada Revised Statutes (NRS) 134.010:

This ensures that the surviving spouse maintains control over jointly owned marital assets.

The distribution of separate property (individually owned assets) depends on the deceased's family situation:

Surviving spouse inherits 100% of separate property (NRS 134.050)

50% to surviving spouse

50% to the child (NRS 134.040)

1/3 to surviving spouse

2/3 split equally among children (NRS 134.040)

50% to surviving spouse

25% to each parent (or 50% to one parent if only one is living) (NRS 134.050)

For those who die without a spouse or will, Nevada law establishes the following order of inheritance:

If no living relatives are found, the property "escheats" to the state of Nevada for educational purposes (NRS 134.120).

As mentioned earlier, a surviving spouse in Nevada inherits all community property and a portion of the deceased's separate property. The exact share of separate property depends on whether the deceased had children and how many.

Children of the deceased inherit equal shares of the remaining separate property after the spouse's share has been allocated. If there is no surviving spouse, the children inherit the entire estate in equal portions.

If there is no surviving spouse or children, other relatives may inherit based on their degree of kinship to the deceased. Parents are next in line, followed by siblings, and then more distant relatives such as grandparents, aunts, uncles, and cousins.

If the gross value of the estate, after deducting mortgages and other security interests, does not exceed $100,000, special preference is given to minor children and/or the surviving spouse. This applies regardless of whether there is a will or not.

Key points:

Additionally, NRS 146.050 provides homestead protection to surviving spouses and minor children.

Nevada law addresses several unique family situations in its intestate succession laws:

Adopted children are treated the same as biological children for inheritance purposes. They have the same rights to inherit as natural-born children of the deceased.

Step-children do not inherit under Nevada's intestate succession laws unless they were legally adopted by the deceased.

Half-siblings inherit the same as full siblings. Nevada law does not distinguish between siblings who share both parents and those who share only one parent.

Non-citizen relatives can inherit under Nevada's intestate succession laws. Immigration status does not affect a person's right to inherit.

It's important to note that not all assets are subject to intestate succession laws in Nevada. Only assets that would have passed through a will are distributed according to these laws. This typically includes:

Intestate succession does not apply to jointly-owned property, accounts with beneficiary designations, or assets held in a living trust. These types of assets typically pass directly to the co-owner or named beneficiary outside of the probate process.

Understanding what assets go through the probate process in Nevada is crucial for properly managing an estate without a will. Some assets may be distributed quickly and easily, while others may require more extensive legal procedures.

Need help with an intestate estate? ClearEstate is here to help. Our team of experienced professionals can guide you through every step of the process, ensuring that your loved one's estate is handled properly and efficiently.

Take the next step: Book a free consultation with ClearEstate today. Let us help you navigate this challenging time with confidence and peace of mind.

Simplify Probate Today

Simplify Probate Today

Get expert guidance from our specialists who've helped 10,000+ families.

Book a free consultation